Non-Face-to-Face ID Verification with AML as a Service

In today’s digital world, ensuring the authenticity of customer identities, especially in non-face-to-face scenarios, is crucial for maintaining compliance and security. AML as a Service provides advanced ID verification solutions designed specifically for these situations.

Key Features

Secure Digital Verification

Verify customer identities remotely with advanced technology that ensures accuracy and reliability, reducing the risk of fraud and identity theft.

Compliance with Regulatory Standards

Meet all AML and KYC requirements, even in non-face-to-face interactions, by leveraging cutting-edge verification processes.

Real-Time Authentication

Instantly verify IDs and other documents, providing quick and seamless onboarding for your customers while maintaining high security standards.

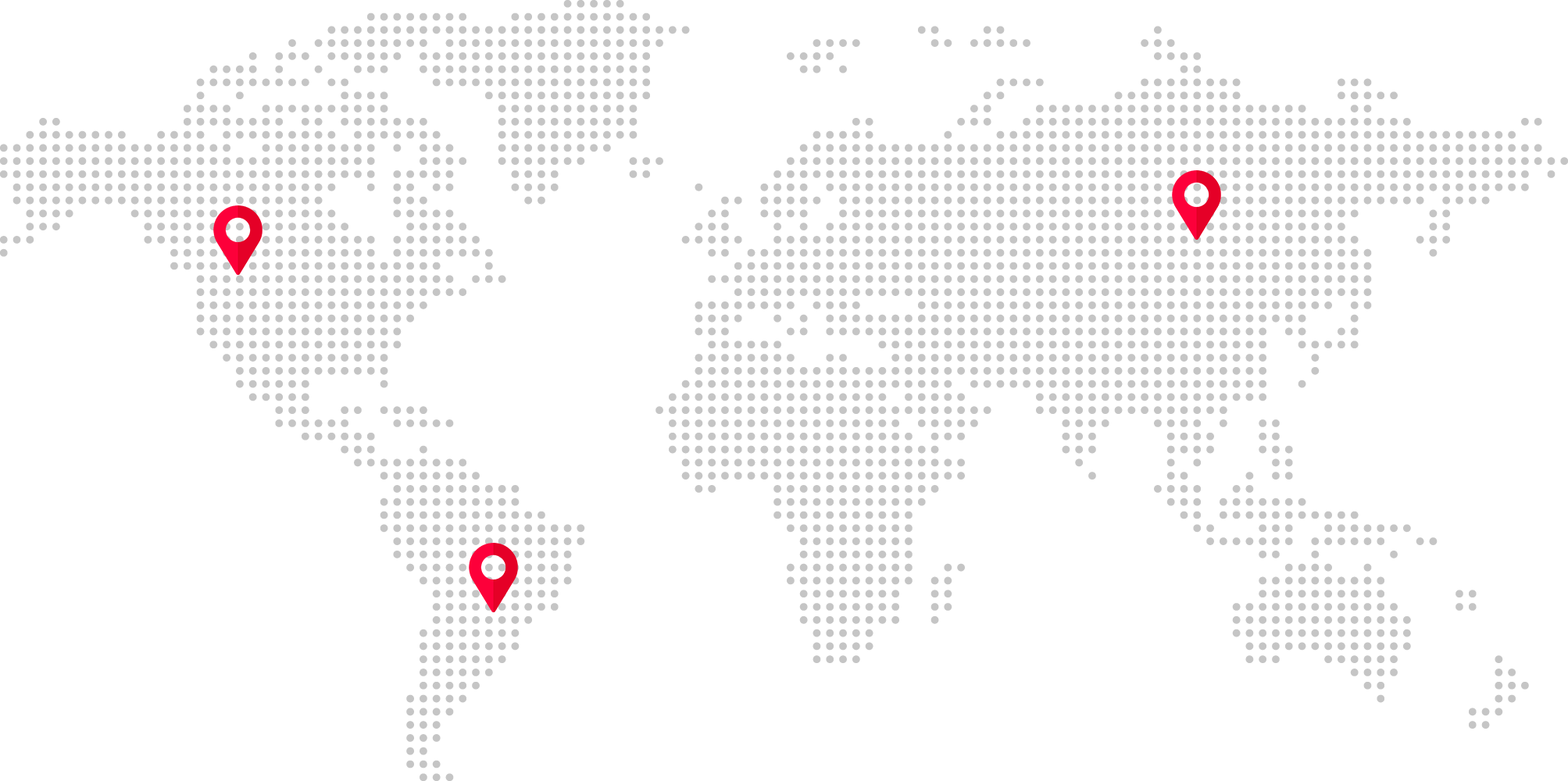

Global Coverage

AML as a Service supports ID verification across multiple jurisdictions, ensuring that your business can operate smoothly on a global scale.

User-Friendly Experience

Provide your customers with a smooth and efficient verification process that doesn’t compromise on security.

Why Choose Non-Face-to-Face ID Verification?

By integrating AML as a Service for non-face-to-face ID verification, you can confidently authenticate customer identities without physical interactions. This not only enhances security but also streamlines your onboarding process, ensuring compliance with regulatory standards while delivering a superior customer experience.